Burke Wealth Management

Burke Wealth Management is an asset management firm serving high net worth

individuals, family offices, and registered investment advisors.

Our flagship product is our Focused Growth portfolio

which is available as a separately managed account consisting

of 18-25 holdings with typical weightings ranging from 2-10%.

This portfolio holds structurally advantaged businesses in attractive industries that possess

long-term secular growth opportunities greater than that of the broader market.

The portfolio is managed

with a long-term time

horizon.

We are owners of

businesses not traders of

stocks.

We are a fundamentals

based bottoms-up research

organization.

Each company is evaluated based on its individual fit with our investment

philosophy and our process is proven and repeatable.

In addition to our Focused Growth portfolio, we offer a Balanced Growth option and a Tactical Growth option so that we can meet the needs of investors with different risk profiles.

Our Balanced Growth product which is available as a separately managed account consists of our focused growth portfolio as well as 6–10 high-quality corporate bonds with a targeted duration of 2 – 10 years. Our Balanced Growth portfolio targets a 60/40 equity to fixed income split with the ability to make adjustments as market conditions dictate.

Tactical Growth is targeted for investors with a longer term time horizon and greater risk tolerance and is available via a fund structure. Tactical Growth holds our Focused Growth portfolio but allows us to utilize leverage to respond to changing market conditions. Tactical Growth will have net exposure ranging from 80% to 150% with a long term target of 120%.

Benefits of using Burke

Wealth Management

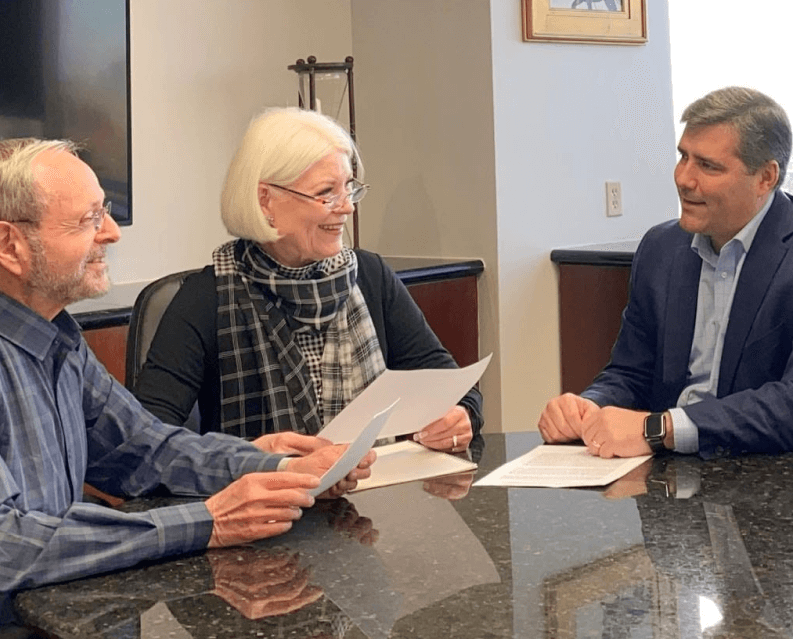

At Burke Wealth Management, we’re providing the type of personalized service that is generally not available from larger banks or mutual fund companies.

Our clients have direct access to members of our investment team, which gives them real time insight into our decision making rationale in what can often be a volatile market. In addition, our separately managed account structure provides complete transparency to their current holdings.

We seek to empower our customers to have a full understanding of the investment philosophy that underpins the management of their account. We believe that this greater understanding will drive long term relationships.